South Texas car title loans offer swift cash access, secured by your vehicle's title, with less stringent credit requirements. Legitimate lenders provide transparent terms, licensed protection, and convenient online applications. Researching lenders and understanding interest rates/repayment periods is crucial for maximizing benefits and making informed choices tailored to individual financial needs.

In the competitive financial landscape of South Texas, choosing the right car title loan lender is crucial for unlocking quick cash opportunities. This article guides you through understanding South Texas car title loans and identifying a reputable lender. We break down essential factors to consider, offering practical tips to maximize benefits and secure the best deal possible. By following these insights, folks in South Texas can harness the power of their vehicle equity efficiently.

- Understanding South Texas Car Title Loans: Unlocking Quick Cash Opportunities

- Factors to Consider When Selecting a Reputable Lender

- Maximizing Benefits: A Guide to Getting the Best Deal on Your Loan

Understanding South Texas Car Title Loans: Unlocking Quick Cash Opportunities

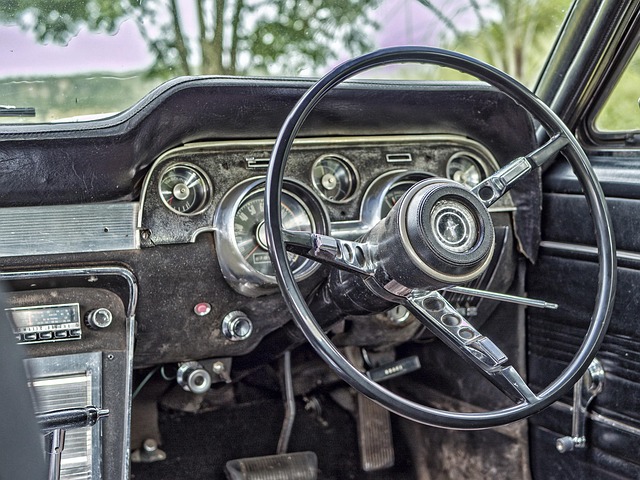

South Texas car title loans offer a unique opportunity for individuals seeking quick cash solutions. This type of loan is secured by the value of your vehicle, allowing lenders to provide funds with less stringent credit requirements compared to traditional bank loans. It’s an ideal option for those in need of emergency funding or looking to bridge financial gaps without undergoing a rigorous credit check. The process involves using your car’s title as collateral, ensuring a quicker turnaround time and potentially more favorable loan terms.

These loans are particularly beneficial for South Texas residents facing unforeseen expenses or those with poor credit histories. By utilizing their vehicle’s equity, borrowers can access substantial funds relatively fast. Additionally, some lenders may offer flexible loan extension options, providing relief during unexpected financial situations. This alternative financing method has gained popularity due to its convenience and accessibility, catering to various personal and emergency funding needs across South Texas.

Factors to Consider When Selecting a Reputable Lender

When selecting a lender for South Texas car title loans, several factors come into play to ensure a secure and beneficial transaction. First, it’s crucial to verify the lender’s legitimacy and reputation. Check if they are licensed and regulated by the appropriate authorities, as this safeguards your rights as a borrower. A reliable lender should have transparent terms and conditions, offering clear details about interest rates, repayment schedules, and any associated fees.

The Title Transfer process is another critical aspect. Reputable lenders will facilitate this process efficiently, ensuring minimal disruption to your daily life. An online Application can also be a significant advantage, allowing you to apply from the comfort of your home. This modern approach streamlines the loan process, making it faster and more convenient. Additionally, look for lenders who provide flexible repayment options tailored to your financial situation, as this can make repaying your title loan much easier.

Maximizing Benefits: A Guide to Getting the Best Deal on Your Loan

Maximizing Benefits: A Guide to Getting the Best Deal on Your Loan

When considering a South Texas car title loan, understanding your options and making informed decisions is key to getting the best deal. One crucial aspect is evaluating lenders based on their terms and conditions, especially regarding interest rates and repayment options. Unlike traditional loans that often require a thorough credit check, South Texas car title loans offer flexibility in this regard, as they are primarily secured by your vehicle’s title. This means even if you have less-than-perfect credit, you can still access funds quickly.

Researching different lenders and comparing their car title loans offerings is essential. Look into various repayment options to find what aligns best with your financial capabilities. Some providers may offer more favorable terms, such as lower interest rates or extended repayment periods, which can significantly impact the overall cost of your loan. Additionally, understanding the process for both borrowing and repaying will help you make a well-informed choice, ensuring you get the most beneficial South Texas car title loans experience.

When selecting a lender for South Texas car title loans, it’s crucial to balance convenience with responsible lending practices. By understanding your loan needs, comparing rates, and checking reviews, you can secure a deal that offers the best benefits while ensuring fair terms. Remember, a reputable lender should provide transparency, flexible repayment options, and a straightforward process, allowing you to access quick cash without unnecessary stress.