South Texas car title loans offer swift cash access using vehicle titles as collateral, catering to diverse financial needs, but require careful comparison of rates and terms to avoid repossession. Key steps include assessing vehicle equity, choosing a reputable lender, preparing necessary documents, ensuring vehicle condition, honestly disclosing financial status, and understanding loan conditions for informed decisions.

Planning ahead for financial needs has never been easier with South Texas car title loans. This comprehensive guide breaks down everything you need to know about this unique lending option, from understanding the basics to exploring the benefits and considerations. By securing a loan using your vehicle’s title, residents of South Texas can access much-needed funds quickly and efficiently. Discover the simple steps involved in the process and take control of your financial future today.

- Understanding South Texas Car Title Loans

- Benefits and Considerations for Borrowers

- Steps to Secure a Loan in South Texas

Understanding South Texas Car Title Loans

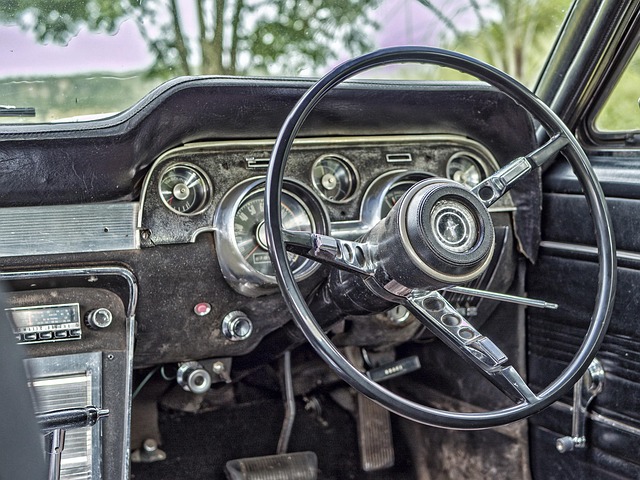

South Texas car title loans are a type of secured lending option designed to provide individuals with quick access to cash using their vehicle as collateral. This alternative financing method is particularly appealing for those in need of immediate funds, such as those facing unexpected expenses or financial emergencies. Unlike traditional bank loans that often require extensive documentation and strict credit criteria, South Texas car title loans offer a simpler process, making them accessible to a broader range of borrowers, including those with bad credit.

The key aspect of these loans lies in the use of one’s vehicle title as collateral, ensuring lenders have security for the loaned amount. Loan terms typically vary based on factors like the value of the vehicle and the borrower’s ability to repay. While interest rates can be higher compared to conventional loans, borrowers with good credit may negotiate more favorable terms. Understanding the specific loan terms and comparing different offers is crucial before securing a South Texas car title loan to ensure it aligns with one’s financial needs and capabilities.

Benefits and Considerations for Borrowers

South Texas car title loans offer a unique financial solution for individuals seeking quick access to cash. One of the primary benefits is their simplicity and speed. Borrowers can use their vehicle’s equity as collateral, allowing them to obtain funds in a shorter time frame compared to traditional loan methods. This can be particularly advantageous during emergencies when immediate funding is required.

Considerations for borrowers include understanding the interest rates attached to these loans. Since they are secured by a vehicle, South Texas car title loans often come with competitive rates, but it’s essential to compare offers from different lenders to ensure fairness. Additionally, while this option provides a rapid financial fix, it’s crucial to have a repayment plan in place to avoid defaulting on the loan, which could result in repossession of the vehicle.

Steps to Secure a Loan in South Texas

Planning to secure a South Texas car title loan involves several clear steps. First, determine your vehicle’s equity by checking its current market value. This information is crucial as it directly impacts the loan amount you can access. Once you know your vehicle’s worth, find a reputable lender offering South Texas car title loans. Compare interest rates, terms, and fees to ensure you’re getting the best deal.

Next, prepare necessary documents including your vehicle’s registration, proof of insurance, and government-issued ID. Lenders will conduct a thorough vehicle inspection to assess its condition and value, so have your vehicle in good working order for an efficient process. During the application process, be transparent about your financial situation to qualify for the best terms. Secure financial assistance when needed by understanding the loan conditions and making informed decisions based on your vehicle equity.

South Texas car title loans can be a practical solution for those seeking quick financial support. By understanding the process, benefits, and considerations outlined in this article, borrowers can make informed decisions. Following the simple steps to secure a loan ensures accessibility and peace of mind. Remember, responsible borrowing is key, so always evaluate your ability to repay before taking out any car title loan.