South Texas car title loans provide fast cash secured by your vehicle's title, but borrowers must understand potential risks like collateral loss and high-interest rates. Responsible borrowing involves evaluating financial situations honestly, weighing benefits against rates and terms, maintaining communication with lenders, and proactive loan management to avoid severe consequences.

In the vibrant landscape of South Texas, understanding your financial options is crucial. If you’re considering a solution like car title loans, this comprehensive guide is your compass. We explore “South Texas car title loans” in depth, from their mechanics to the benefits and risks involved. Learn how to secure a loan responsibly, making informed decisions that suit your unique situation. Empower yourself with knowledge – the first step towards financial protection.

- Understanding South Texas Car Title Loans: A Comprehensive Guide

- Benefits and Risks: Weighing Your Options Wisely

- Securing Your Loan: Tips for Responsible Borrowing in South Texas

Understanding South Texas Car Title Loans: A Comprehensive Guide

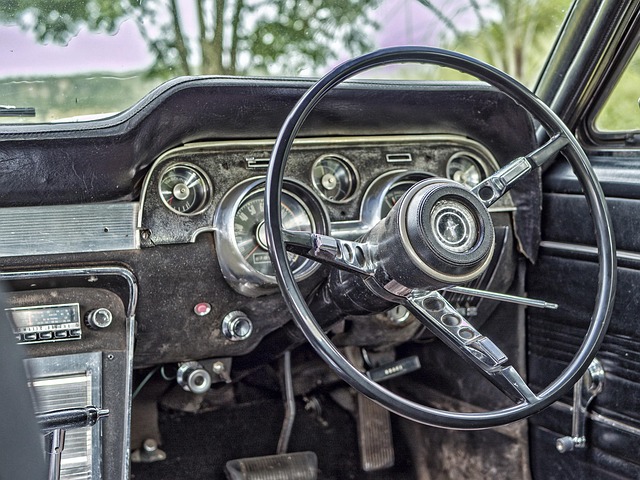

South Texas car title loans are a financial solution that offers quick funding for those needing cash fast. This type of loan is secured by your vehicle’s title, which means the lender has a legal claim on your car if you fail to repay the loan. However, as long as you keep your payments up, you’ll maintain full use of your vehicle.

This comprehensive guide aims to demystify South Texas car title loans and empower individuals to make informed decisions. Understanding how these loans work is crucial when considering a short-term financial solution. With the convenience of quick funding, keeping your vehicle remains within your control, offering peace of mind during challenging financial times.

Benefits and Risks: Weighing Your Options Wisely

When considering South Texas car title loans, it’s crucial to weigh both the benefits and risks involved. These loans offer a unique opportunity for individuals seeking emergency funding with the use of their vehicle collateral. It provides quick access to cash, which can be particularly beneficial during unexpected financial emergencies. The simplicity of the process is appealing, as it often requires less paperwork and stricter credit checks compared to traditional loan options. This makes it accessible to a broader range of individuals who might not qualify for other types of loans.

However, the risks associated with these loans should not be overlooked. The primary concern is the potential loss of vehicle ownership if the borrower fails to repay the loan according to the agreed-upon terms. This can be detrimental, especially for those relying on their vehicles for daily transportation and livelihood. Additionally, high-interest rates are a common feature of such loans, which can lead to a cycle of debt if not managed carefully. Borrowers must thoroughly understand the repayment conditions, interest calculations, and potential fees to make an informed decision, ensuring they have a clear path to repaying the loan without sacrificing their vehicle ownership or facing significant financial strain.

Securing Your Loan: Tips for Responsible Borrowing in South Texas

When considering South Texas car title loans or other forms of financing like semi truck loans, responsible borrowing is key to protecting yourself. Before securing a loan, ensure you understand the terms and conditions thoroughly. Lenders in South Texas often offer flexible options, such as online applications, making it easier than ever to apply for a car title loan. However, it’s crucial to weigh the benefits against the interest rates and repayment terms.

Evaluate your financial situation honestly. Only borrow what you can afford to repay, considering potential unforeseen circumstances. Remember that late payments or defaulting on your loan can lead to serious consequences, including repossession of your asset (in this case, your vehicle). Responsible borrowing means maintaining open lines of communication with your lender and being proactive in managing your loan to avoid such outcomes.

South Texas car title loans can offer a much-needed financial safety net, but it’s crucial to approach them responsibly. By understanding how these loans work, weighing the benefits and risks, and following secure borrowing practices, you can protect yourself while accessing the funds you need. Always remember that informed decisions lead to positive outcomes, ensuring a smoother journey through financial challenges.