South Texas car title loans provide a swift and accessible financial safety net for residents facing unexpected expenses. With minimal paperwork, simple processes, and tailored payment plans, these loans offer a transparent solution for diverse budget needs, from medical emergencies to business investments, enabling better financial management and peace of mind.

“Explore authentic narratives from South Texas residents who have turned to car title loans as a solution for their financial hardships. This article delves into the real-life experiences of borrowers, offering a unique perspective on how these loans have helped them overcome challenges. From sharing their journeys to discussing the tangible benefits, we uncover the positive impact of South Texas car title loans on everyday lives. Discover personal stories that highlight a practical and accessible financial option.”

- Borrowers Share Their Experiences: A South Texas Perspective

- Overcoming Financial Challenges: Car Title Loans in Action

- Real Results: How These Loans Impacted Lives Positively

Borrowers Share Their Experiences: A South Texas Perspective

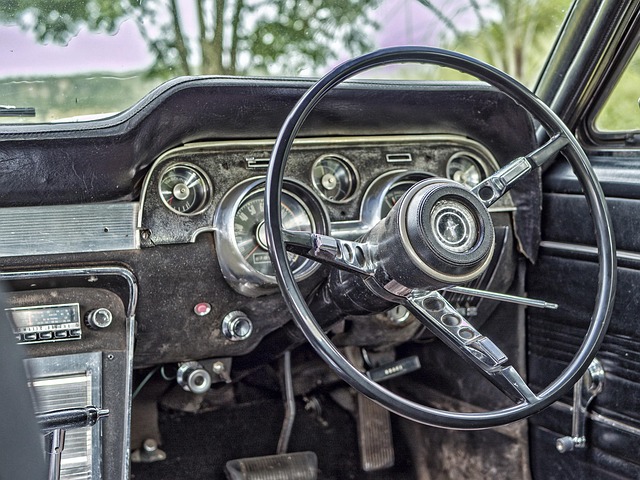

In South Texas, residents often turn to car title loans as a solution for unexpected financial burdens. These short-term funding options have gained popularity due to their accessibility and speed. Borrowers share that the process was surprisingly straightforward, with minimal paperwork and fast cash dispensed. Many appreciate the flexibility of payment plans tailored to suit different income streams.

One consistent theme in these real stories from South Texas car title loan borrowers is the relief they felt upon receiving the vehicle inspection results. The transparency of this step built trust between borrowers and lenders. Fast cash wasn’t just a promise; it was a reality for many, offering a lifeline during urgent financial situations.

Overcoming Financial Challenges: Car Title Loans in Action

In South Texas, many residents face unexpected financial challenges that require immediate solutions. For those with vehicle equity, South Texas car title loans offer a lifeline. This alternative financing method allows individuals to borrow money using their vehicle’s title as collateral, ensuring a quicker and more accessible lending process compared to traditional bank loans. By leveraging their vehicle equity, borrowers can gain the financial stability they need to navigate through tough times.

Whether it’s covering urgent medical bills, unexpected home repairs, or bridging the gap until their next paycheck, South Texas car title loans provide a safe and secure option for borrowers. Unlike unsecured loans that may come with stringent credit requirements, these secured loans use the vehicle as security, making them more accessible to individuals with varying credit histories. Even those who own semi trucks can take advantage of truck loan options tailored to meet their specific needs, ensuring they have the financial resources to keep their businesses running smoothly.

Real Results: How These Loans Impacted Lives Positively

For many residents of South Texas, car title loans have been a lifeline, offering much-needed financial assistance during challenging times. These loans, secured by an individual’s vehicle, provide a unique opportunity for borrowers to access funds quickly and conveniently. The positive impact on their lives is undeniable.

The flexibility of payment plans associated with these loans has allowed borrowers to manage their finances better. With the option of flexible payments, they can choose terms that fit their budgets, ensuring they make manageable monthly installments without the burden of overwhelming debt. This financial assistance has enabled folks to cover unexpected expenses, repair their vehicles, or even invest in business opportunities, ultimately contributing to improved living standards and a sense of security.

In the heart of South Texas, real people have found tangible solutions to their financial struggles through car title loans. Their stories, as shared, underscore the transformative power of these unique lending options. By leveraging their vehicles’ equity, borrowers have not only overcome immediate monetary challenges but also laid a foundation for future financial stability and growth. The positive impact of South Texas car title loans is evident in the real results achieved by these individuals, proving that when financial need meets innovative lending practices, success can be within reach.