South Texas car title loans have gained popularity due to their flexible structure and benefits. Using vehicle equity as collateral, these loans offer swift approval, lower interest rates, and extended repayment terms compared to traditional banking options. Ideal for urgent cash needs, they appeal to those with less-than-perfect credit, but borrowers must be aware of repossition risks if repayments are missed.

South Texas car title loans have emerged as a popular financial solution, offering an alternative to traditional banking. This article explores the growing appeal of this unique lending option within the region. We’ll provide a comprehensive breakdown, starting with a basic understanding of South Texas car title loans and their key features. Then, we’ll delve into the primary factors driving their popularity, followed by an analysis of advantages and considerations for borrowers seeking these loans.

- Understanding South Texas Car Title Loans: A Quick Overview

- Key Factors Driving Their Growing Popularity

- Advantages and Considerations for Borrowers Today

Understanding South Texas Car Title Loans: A Quick Overview

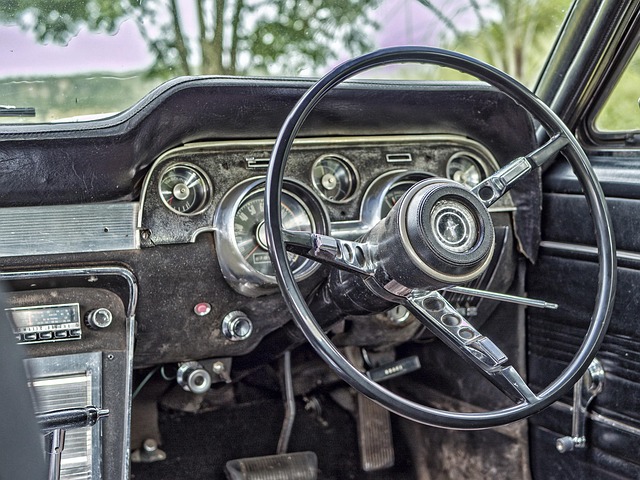

South Texas car title loans have gained significant popularity due to their unique structure and benefits, offering a quick solution for individuals seeking financial assistance. This type of loan utilizes a person’s vehicle as collateral, allowing lenders to provide funds based on the vehicle’s value. The process is straightforward; borrowers can apply for a loan by submitting their vehicle’s details, including its make, model, year, and overall condition, which influences the loan amount offered. Lenders then assess the vehicle’s valuation to determine the credit limit.

Unlike traditional loans, South Texas car title loans provide an advantage with flexible repayment terms and the option of extending the loan period if needed. This feature is particularly appealing to borrowers who may experience unexpected financial setbacks during the loan tenure. The ability to use one’s vehicle as collateral ensures that these loans come with relatively lower interest rates compared to other short-term financing options, making them an attractive choice for those in need of quick cash.

Key Factors Driving Their Growing Popularity

In the dynamic financial landscape of South Texas, car title loans have emerged as a popular and accessible solution for many residents seeking quick funding. The growing popularity of South Texas car title loans can be attributed to several key factors. One of the primary drivers is their efficiency; these loans offer a remarkably swift approval process compared to traditional bank loans, making them an attractive option for those in urgent need of cash. The simplicity and convenience of the application procedure are significant advantages, especially for individuals with limited or no credit history.

Another critical aspect contributing to their success is the use of vehicle collateral. This approach ensures that lenders have a secure interest in the borrower’s asset, which can lead to lower interest rates. Lower borrowing costs make these loans an appealing choice for borrowers, allowing them to manage their finances more effectively and potentially save on overall interest expenses. The quick approval and competitive interest rates, combined with the convenience of using one’s vehicle as collateral, have collectively propelled South Texas car title loans to the forefront of alternative financing options in the region.

Advantages and Considerations for Borrowers Today

South Texas car title loans have gained significant popularity in recent years due to their unique advantages that cater to borrowers’ needs. One of the primary benefits is the accessibility they offer, especially for those with less-than-perfect credit or limited banking history. Unlike traditional loan options, these loans use a vehicle’s equity as collateral, allowing individuals to secure funding by pledging their car title. This alternative financing method provides an opportunity for borrowers to gain access to substantial cash amounts without strict credit requirements.

For today’s borrowers, considering South Texas car title loans offers several practical advantages. It enables debt consolidation, helping individuals merge multiple high-interest debts into a single loan with potentially lower rates. Moreover, the eligibility criteria are broader than conventional loans, making it accessible to more people. However, borrowers should be mindful of potential drawbacks, such as the risk of repossession if they fail to repay the loan on time. It’s crucial for prospective lenders to carefully assess their financial situation and understand the implications before opting for a car title loan, especially when considering alternatives like Semi Truck Loans or exploring improved loan eligibility through better credit management.

South Texas car title loans have emerged as a popular financial solution, catering to various borrower needs. With their unique approach to lending, these loans offer accessibility and flexibility, making them an attractive option in today’s market. By understanding the key factors driving their popularity and considering the advantages for borrowers, individuals can make informed decisions when exploring South Texas car title loan options to meet their immediate financial requirements.